Exceptional Claims Management Services

About Us

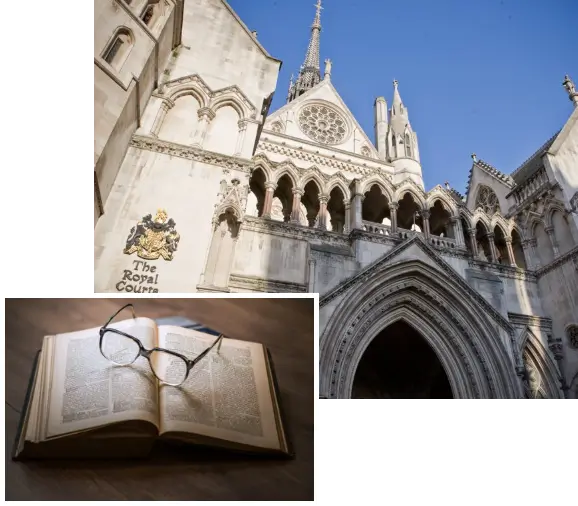

Established in 2018 Mitre Claims Management is a boutique third party claims administrator specialising in managing Professional and Financial Lines insurance claims on behalf of policyholders and insurers. Employing a team of qualified solicitors, Mitre is able to deliver both market leading claims strategy along with in house assistance in the legal defence of claims for their clients.

As a member of the Inperio Holdings group of companies, Mitre is able to draw on the knowledge and experience of their broking, underwriting and law firm colleagues giving them unparalleled access to experienced technical and legal leaders in the field.

Independent Claims Management

Mitre is one of the few specialist independent claims management companies working for Policyholders and Insurers.

Specialist Legal Background

The Mitre team consists of skilled claims handlers with extensive past experience as professional negligence solicitors, enabling us to manage a higher volume of claims in-house.

Cost Effective Claims Solutions

Mitre combines its expert legal and insurance knowledge to deliver efficient, cost effective outcomes.

SUPPORT CENTER

020 4530 8997 Contact us

Our services

We are dedicated to guiding you on your claims journey.

Why choose us

Building trust through transparency and integrity

Specialist Expertise

We have extensive experience in handling professional and financial claims, delivering expert and strategic solutions

Efficiency & Precision

We manage claims swiftly and meticulously, minimising risks and maximising results.

Tailored

Approach

We provide personalised advice for each case, ensuring the best possible outcome for every client.

Integrity & Transparency

We operate with honesty and professionalism, ensuring a clear and beneficial process for our clients.

Our team

Meet the team

Our team consists of qualified solicitors who lead our claims strategies, ensuring robust and expert legal support throughout the claims process.

Claire Swift

Head of Claims

Claire qualified at insurance law firm Barlow Lyde & Gilbert and has over 25 years’ experience handling professional indemnity claims. She has worked in private practice and as a senior claims manager in-house. Skilled in dispute resolution through litigation, arbitration, and ADR, she oversees claims management at Mitre, ensuring efficient handling and compliance with TPA terms.

Alison Mackintosh

Claim solicitor

Alison trained with a specialist insurance law firm in the City and has more than 30 years’ experience in handling claims against professionals, including surveyors, accountants, solicitors and financial intermediaries, as well as dealing with coverage matters. She worked as a solicitor with DAC Beachcroft and Plexus Law prior to joining Mitre Claims Management, where she handles a wide range of claims and oversees the defence of claims by panel, if required

Sikandar Zaman

Claim counsel

Sikandar, an Australian-qualified solicitor, has handled professional indemnity claims for insurers like QBE and Allianz in Australia and the UK. Currently pursuing CII accreditation, he combines legal expertise with deep insurance market knowledge to ensure effective claim resolution under policy terms.

Recent Blog

Journal from binox

We believe that the human dimension essential to start any successful client tax preparation services.

Frequently asked question

Mitre is a specialist firm providing expert claims management, based in a background of strong legal expertise. We offer strategic solutions to ensure compliance, efficiency, and cost-effective claims handling.

We provide a range of services, including:

•Policy evaluation and compliance guidance

•Coverage advice for insurers

•Legal coordination for litigated claims

•Direct claims negotiation and settlement

•Financial management through designated client accounts

•Risk mitigation and dispute resolution

Yes, we work with approved panel law firms and barristers to manage litigated claims, ensuring the best legal representation and strategic case management.

Yes, Mitre claims negotiate and settle claims without the need for panel solicitors, reducing costs and expediting the resolution process.

We provide detailed coverage and policy advice to policy holders to help them understand policy terms, exclusions, and obligations to ensure informed decision-making.

Yes, we assist policy holders in drafting letters before action pursuant to the pre-action protocol, ensuring that all relevant deadlines are met and any claim is robustly defended from the outset.

Yes, we directly instruct barristers and legal counsel for expert advice on complex claims, ensuring efficient case handling and cost-effective solutions.

A designated client account is a secure financial structure used to facilitate settlement transactions, ensuring transparency, compliance, and efficient fund management.

We adhere to strict financial regulations and provide transparent reporting to insurers, ensuring all transactions meet legal and industry standards.

You can contact us via our website, email, or phone. Our team will be happy to discuss your specific needs and provide tailored solutions.